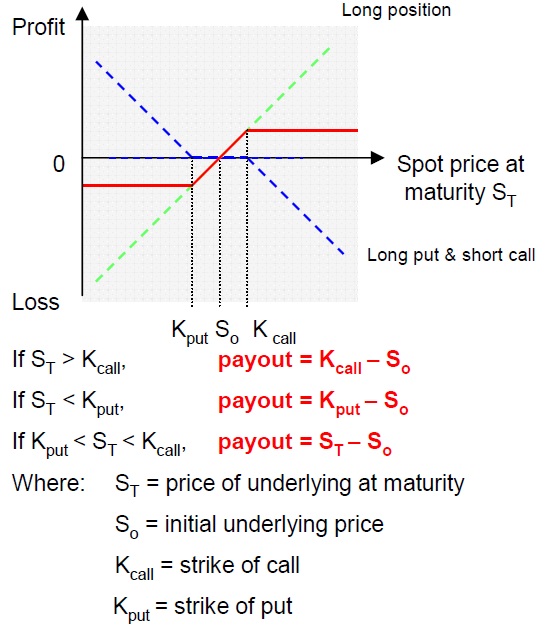

Collar Option Payoff

Derivatives advanced module national stock exchange of india limited free download as pdf file pdf text file txt or read online for free.

Collar option payoff. What is costless or zero cost collar. See detailed explanations and examples on how and when to use the costless or zero cost collar options strategy. What is collar strategy. See detailed explanations and examples on how and when to use the collar options trading strategy.

Ermst laurent is correct. The payoff is the same but the approach is different. Bull call spread long call low strike short call high strike. An asian option or average value option is a special type of option contract.

For asian options the payoff is determined by the average underlying price over some. In mathematical finance a monte carlo option model uses monte carlo methods to calculate the value of an option with multiple sources of uncertainty or with. You have the option of staying home or coming with us. He has the option to cancel the deal.

We have a wide range of options available to us. Day in the life of an options trader. The hours the stress the greeks what your day will look like and client requests idea generation.