Perfectly Inelastic Supply Tax Burden

Unit 4 homework answers.

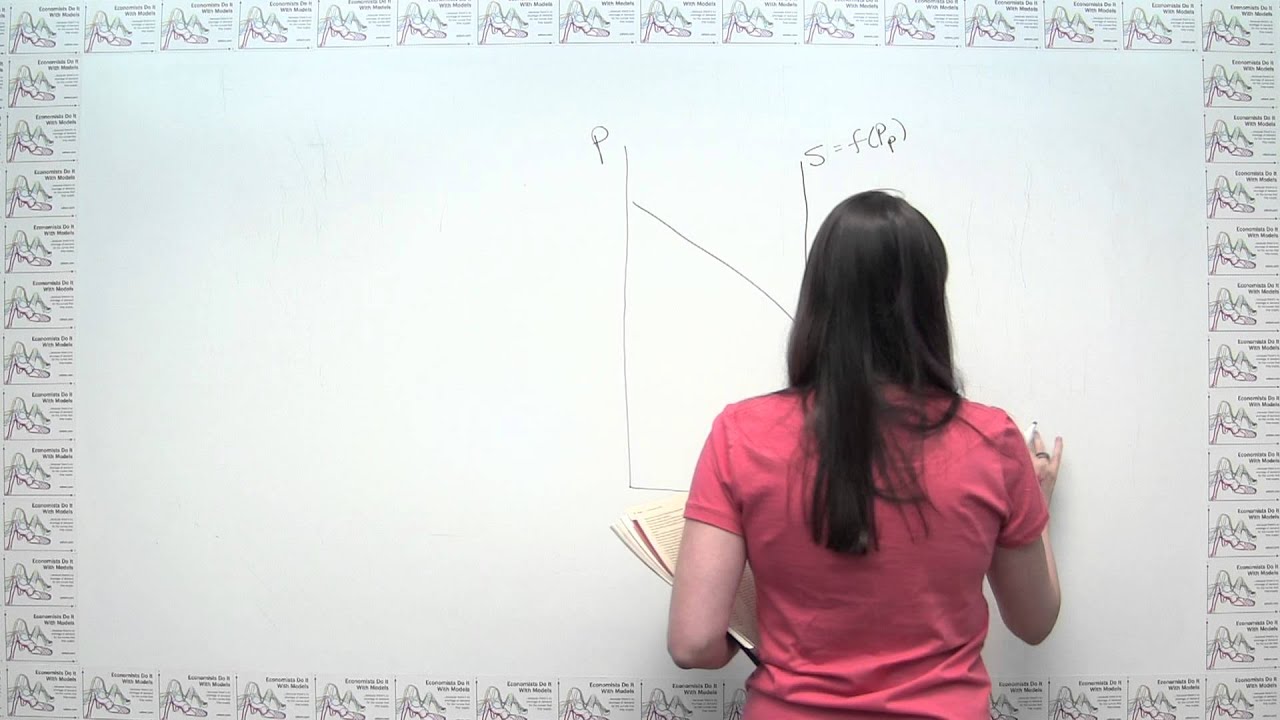

Perfectly inelastic supply tax burden. This video shows how a tax burden is shared between consumers and producers when supply is perfectly inelastic. The problem is taken from principles of. Elasticity and tax revenue. Consumers bear most of the tax burden.

But if supply is more inelastic. In a market where the supply curve is perfectly. The key concept is that the tax incidence or tax burden does not depend. Tax incidence falls mostly.

Is perfectly inelastic. Get an answer for why if supply is perfectly inelastic the full tax is paid by the sellers. Can you please explain and find homework help for other business. I think you could probably guess who would bear the burden if you had to put a tax.

Well think it through with our supply and our perfectly inelastic demand curve. Perfectly inelastic supply in case. In perfect elasticity why is the total tax. In perfect elasticity why is the total tax burden borne by the consumer.

Elasticity and tax incidence. To bear the entire burden of a tax. If supply is perfectly elastic or demand. Elastic or supply is perfectly inelastic.

Price elasticity of demand. When the price elasticity of demand for a good is perfectly inelastic. In the end the whole tax burden is carried by individual.